Hospital Indemnity

Effingham County Schools offers Hospital Indemnity coverage through Unum. The Unum Hospital Indemnity plan is designed to provide financial protection for covered individuals by paying benefits for hospitalizations and, in some cases, for treatment related to accidents or illnesses. Employees can use these benefits to cover out-of-pocket expenses and additional bills that may arise. Lump sum payments are made directly to the employee according to the coverage amounts specified in the schedule of benefits. There are no exclusions for pre-existing conditions, and pregnancy is treated like any other medical condition.

Wellness Benefit Included

To promote healthy habits and preventive care, the plan offers a wellness screening benefit of $50, available once per person each calendar year. Eligible screenings include, but are not limited to:

- Cholesterol and diabetes screenings

- Cancer screenings

- Cardiovascular function assessments

- Imaging studies

- Annual physician examinations

- Immunizations

For a comprehensive list of eligible screenings, please refer to the policy.

| Schedule of Benefits | Amount |

|---|---|

| Admission (4 days per year) | $1,000 |

|

Admission - Hospital ICU (4 days per year) (additive to Admission) |

$1,000 |

| Daily Stay |

$100 (per day up to 30 days) |

| Daily Stay - Hospital ICU (additive to Daily Stay) |

$100 (per day up to 15 days) |

Accident

Accident coverage is provided through Unum, and designed to assist covered employees in managing out-of-pocket expenses and additional bills that may arise from accidental injuries, whether they are minor or severe. This plan offers indemnity lump-sum benefits, which are paid directly to the employee according to the coverage amounts specified in the schedule of benefits. One of the key advantages of the Unum accident plan is that it is guaranteed issue, meaning no health questions are required for enrollment, ensuring easy access to this important coverage. The plan also offers an additional benefit for accidents sustained as a result of an organized sporting activity.

This plan provides reimbursement for your actual medical expenses, with benefits paid directly to you. Coverage options are available for you, your spouse, and your dependent children. Additionally, the plan includes benefits for death, loss of limbs, hospital visits, and ambulance transportation resulting from a covered accident. For more details, please refer to the plan summary.

| Injury | Benefit |

|---|---|

|

Hospital Care

|

|

| Per Admission Benefit | $1,500 |

| Daily Stay Benefit | $350/day up to 365 days |

| Surgery |

$1,000 (abdominal, thoracic, or cranial) |

|

Medical Care Benefits (Non-hospital)

|

|

| Doctor visit | $125 |

| Emergency Room | Urgent Care | $250 |

| Follow-up treatment | $125 (max of 6) |

| Physical | Occupational Therapy | $75 (max of 15) |

| Medical equipment | $50 to $200 |

| Outpatient Surgery | $200 |

| Medical Imaging | $100 to $300 |

| Ambulance: Air | Ground | $1,500 | $500 |

|

Injury-Based Benefits

|

|

| Burns | $750 to $15,000 |

| Concussions | $200 |

| Lacerations | $65 to $800 |

| Dislocations | $200 to $4,125 |

| Fractures | $275 to $5,500 |

|

Accidental Death and Dismemberment (AD&D)

|

|

| Employee | $75,000 |

| Spouse | $37,500 |

| Child(ren) | $18,750 |

|

Organized Sports Benefit

|

|

| Covers accidents as a result of an organized sporting activity | Pays an additional 25% for injury and treatment categories |

Important Notes

- Employees are eligible regardless of age

- Coverage for eligible child dependent(s) is up to age 26

- Portable upon separation from employment with the district by remitting premiums directly to Unum.

Need to File a Claim?

To submit an Accident claim, follow the steps below:

Register or access your MyUnum for Members account online at unum.com/claims or on the Unum Mobile App.

Submit a claim by phone at (800) 635-5597.

Critical Illness

Effingham County Schools offers voluntary Critical Illness insurance through Unum. This coverage provides a lump-sum benefit upon the diagnosis of a covered illness. The benefit amount depends on your selected coverage, the diagnosed condition, and the terms of the policy. You can choose coverage for yourself and your spouse, with automatic coverage for children at 50% of the employee's coverage amount.

Coverage amount for employees and spouses are available in $5,000 increments, as follows:

Employee: $5,000 to $20,000

Spouse: $5,000 or $10,000, up to 50% of the employee amount (employee must be enrolled in coverage to elect spouse coverage)

Child(ren) to age 26: Automatically covered at 50% of the employee amount elected

There are no health questions when enrolling in this benefit. Additional information on the plans is below.

Features

Critical Illness insurance offers valuable financial protection when facing serious medical conditions. With this coverage, benefits are paid directly to you, in addition to any other insurance you may have. Whether it's covering medical bills, recovery expenses, or non-medical costs, this plan provides flexible financial support. The plan also offers multiple payouts for the same or different covered conditions.

Wellness Benefit Included

The voluntary Critical Illness plan includes a wellness benefit for covered preventive screenings, including but not limited to:

- Annual exams by a physician

- Cholesterol and diabetes screenings

- Cancer screenings

- Imaging studies

- Immunizations

Every year, each family member who has Critical Illness coverage can receive $50 for getting a covered Be Well Benefit screening test. Simply submit your claim form along with proof of your screening to receive your screening benefit.

Building Benefit + Additional Cancer Benefit

The Unum Critical Illness plan offers added financial security for employees and their families by helping cover unexpected costs from a serious accident or medical diagnosis. Two key features of this plan are the Building Benefit and the Additional Cancer Benefit, both designed to provide extra support when it matters most.

Building Benefit: Coverage That Grows Over Time

With the Building Benefit, your coverage increases the longer your policy is active, offering more financial protection as time goes on. This benefit is automatically applied to eligible claims, providing a welcome financial boost when you need it.

- 13–36 months: Coverage increases by 5%

- 37–60 months: Coverage increases by 10%

- 61+ months: Coverage increases by 15%

For example, if your base benefit is $20,000 and you’ve had the policy for 37 months, your payout would increase by 10%, bringing your total benefit to $22,000.

Additional Cancer Benefit: Extra Support During Treatment

If you are undergoing treatment for a covered cancer diagnosis, this benefit provides extra monthly payments to help ease financial stress. You can receive payments for up to 10 months or until you reach an additional 100% of your original policy payout.

Click here to learn more.

Need to File a Claim?

To submit a Critical Illness claim, follow the steps below:

- Register or access your MyUnum for Members account online at unum.com/claims or on the Unum Mobile App.

- Submit a claim by phone at (800) 635-5597.

Portability

This plan is portable, allowing you to continue coverage by paying premiums directly to Unum if you leave your employment with the district.

| Covered Diagnoses and Conditions |

|---|

| End stage renal (kidney) failure |

| Heart attack |

| Major Organ Failure Requiring Transplant |

| Stroke |

| Sudden Cardiac Arrest |

| Coronary Artery Disease: Major and Minor (limited benefit) |

| Invasive Cancer (including all breast cancer) |

| Non-invasive Cancer (25% benefit) |

| Skin Cancer ($500) |

| Benign Brain Tumor |

| Coma |

| Loss of hearing, sight, speech |

| Occupational PTSD |

| Permanent Paralysis |

| Progressive Diseases: Addison's Disease, ALS, Dementia, Functional Loss, Huntington's Disease, Lupus, Multiple Sclerosis, Muscular Dystrophy, Myasthenia Gravis, Parkinson's Disease, Systemic Sclerosis |

| Critical Illnesses for Children: Cerebral Palsy, cleft lip or palate, congenital heart disease, Cystic Fibrosis, Down Syndrome, Sickle Cell Anemia, Spina Bifida, Type 1 Diabetes |

| See full certificate for additional covered conditions |

Dental

United Concordia offers an extensive dental plan network and competitive employee premiums. The benefits for the United Concordia Base Plan, Core Plan, and Buy-Up Plan are very similar to the existing plan options. All plans include 100% coverage for preventive care, with two cleanings every 12 months and no deductible for preventive care services. The Base Plan features the lowest premiums and covers preventive and basic services, with a lower annual maximum. The Core Plan has higher premiums and a higher annual maximum, but does not cover orthodontics. The Buy-Up Plan is the most comprehensive, offering the highest annual maximum and orthodontic coverage for dependents to age 19. Dependent children can be covered up to age 26.

The United Concordia Dental Elite Plus plan offers coverage both in and out of network, but you’ll get the most value from your benefits by visiting United Concordia Elite Plus dentists. We encourage you to choose a participating provider to minimize out-of-pocket costs and help control the plan's long-term expenses. To find in-network providers, visit the United Concordia website and select the Elite Plus Network. You can also download their secure mobile app for easy access to provider information.

Below is a benefit summary of your annual deductible and coinsurance costs.

| United Concordia Elite Plus | Base Plan | Core Plan | Buy-Up Plan |

|---|---|---|---|

|

Calendar Year Deductible

|

$50 Individual | $150 Family | $75 Individual | $225 Family | $75 Individual | $225 Family |

|

Type A - Preventive Services (Deductible Waived): Cleanings and exams

|

Plan pays 100% | Plan pays 100% | Plan pays 100% |

|

Type B - Basic Services (After Deductible): Fillings, simple extractions, X-rays, and more

|

Plan pays 80%, after deductible |

Plan pays 80%, after deductible |

Plan pays 80%, after deductible |

|

Type C - Major Services (After Deductible): Oral surgery, implants, crowns, and more

|

Not Covered |

Plan pays 50%, after deductible |

Plan pays 50%, after deductible |

|

Type D - Orthodontia; up to age 19 (After Deductible):

|

Not Covered | Not Covered |

Plan pays 50%, after deductible |

|

Orthodontia Lifetime Maximum

|

Not Covered | Not Covered | $2,500 per person |

|

Annual Maximum (per person)

|

$500 per person | $1,250 per person | $1,500 per person |

Important Notes

- No age limitations for coverage, with the exception of orthodontia coverage for the Buy-up Plan which is up to age 19.

- The deductible is waived for preventive services. The plans have different annual maximum benefit amounts.

- One member ID card will be issued per family.

Claims Process

In-Network

- Participating United Concordia Elite Plus dentists file the claim and accept payment from United Concordia.

- Employees should not need to pay at the time of service for participating providers.

Out-of-Network

- For out-of-network dentists, if the dentist does not agree to file the claim as out-of-network with United Concordia, employee pays at the time of service and files a claim for reimbursement.

- The plan reimburses at the 90th percent of Usual and Customary (U&C) for out-of-network providers. Charges by out-of-network providers that exceed U&C are the member’s financial responsibility. (Member pays the difference between the actual charge and the plan’s U&C reimbursement level.)

Find a Dentist Tool

Effingham County School employees can easily find in-network dentists with the United Concordia Dental Find a Dentist tool. Whether you're at home or on the go, this simple search tool makes it fast and convenient to locate nearby providers, ensuring you receive quality dental care when you need it most.

Discounts for Non-Covered Services: United Concordia PPO members have access to networks that offer discounts for services, whether they are covered on the dental plan or not. To locate participating dentists, look for the green $ave! icon in the Find a Dentist tool on UnitedConcordia.com.

MyDentalBenefits account

Stay informed about your dental coverage with a MyDentalBenefits account. With this account, you can:

- View coverage details.

- Check claims and payments.

- Print additional ID cards.

- Access other helpful tools.

Setting up your account is easy! After your plan's effective date, visit UnitedConcordia.com/GetMDB to get started. You’ll need your Social Security Number or Member ID to complete the setup.

For quick access, simply scan the QR code below.

My Dental Assessment

My Dental Assessment is available to all enrolled members. This online tool helps you identify oral health risks and understand how your lifestyle and medical conditions may affect your oral health. After completing the assessment, you can print it out and bring it to your next dental check-up to discuss any concerns with your dentist or hygienist. Start your assessment today at www.unitedconcordia.com/GetMDB.

College Tuition Benefit

As a United Concordia Dental plan member, you not only protect your oral health but can also ease the financial burden of college tuition with the College Tuition Benefit® savings program. This unique feature helps you and your family save on education costs by earning Tuition Rewards® points, which can be redeemed for tuition discounts at over 400 private colleges and universities nationwide. Visit the Resources page to learn more.

Chomper Chums®

Make brushing, flossing, and rinsing fun for kids with our Chomper Chums® app! This engaging app helps your child:

- Use a timer to brush for the recommended 2 minutes

- Master proper brushing and flossing techniques

- Discover the importance of healthy eating

Download Chomper Chums® today from the Apple App Store or Google Play!

Member Portal

Please watch the video below for information on the Member Portal.

Universal Life

Trustmark’s portable Universal Life products address varying employee needs for permanent life insurance and peace of mind for a lifetime. Universal Life Insurance is a voluntary product that you may elect in addition to Voluntary Life & AD&D. You have two Universal Life insurance options from which to choose: Universal Life & Universal LifeEvents with Long Term Care.

Option 1: Universal Life Insurance

Universal Life Insurance helps protect your family from money issues if you or your spouse pass away. Your price won’t increase due to age, and your policy builds cash value over time. You can choose a benefit amount that works for you, and use your cash benefit to pay for whatever you need most – for example, funeral costs, home payments, tuition, savings or any other bills.

Universal Life is an affordable way to help fulfill your responsibility to your loved ones and be certain they’ll be taken care of.

This option includes a death benefit that remains constant as long as premiums are paid, but it does not include a long term care benefit. Premiums are higher for this option because the death benefit does not reduce due to age. Cash value accumulation is also higher with this permanent life option.

Option 2: Universal LifeEvents Insurance with Long Term Care

Universal LifeEvents helps protect your family from money issues if you or your spouse pass away. It can also help pay for the high costs of long term care services, and gives you a higher death benefit during your working years and a long-term care benefit that never reduces. Your price won’t increase due to age, and your policy builds cash value over time.

This option provides a higher death benefit during working years when the need for life insurance is typically the highest. Option 2 also includes a long term care benefit for home care, assisted living, adult day care, and nursing home care. The monthly long term care benefit equals 4% of the face amount for up to 25 months. Today’s population is more in need of long term care than ever before. Annually, more than 8.5 million people receive support for long term care services. A private room in a nursing home can cost $225 per day or $6,965 per month.

The following apply to both options:

- Convenient payroll deduction

- Flexibility to adjust the death benefit, premiums, and cash value as your needs change

- Ability to surrender coverage for the cash value or draw premiums from the cash value once accumulated

- Accelerated death benefit of 75% when life expectancy is 24 months or less

- Maturity date is age 100

Coverage Options

Employee and spouse coverage is available in $10,000 increments up to $300,000. Guaranteed issue coverage may be available. Child coverage is available up to $35,000 (depending on child age).

Employees are not able to elect both Universal Life and Universal LifeEvents with Long Term Care.

Issue Age Eligibility

| Universal Life | Universal LifeEvents with Long Term Care | |

|---|---|---|

| Employee | Ages 18 to 75 | Ages 18 to 64 |

| Spouse | Ages 18 to 70 | Ages 18 to 64 |

| Children | To Age 23 | To Age 23 |

Plan Comparison

| Item | Universal Life | Universal LifeEvents with Long Term Care |

|---|---|---|

| Level Life Insurance Benefit Regardless of Age | Yes | No. Death benefit reduces to 1/3 at the latter of age 70 or the 15th policy anniversary. |

| Cash Value | Higher Cash Value | Lower Cash Value |

| Long Term Care Benefit | Not Included | Included |

| Premiums | Higher than Universal LifeEvents with LTC | Lower than Universal Life |

Differences between Permanent Universal Life and Traditional Whole Life

- With Trustmark’s permanent universal life policies, you may change your premiums and death benefit at any time. With traditional whole life insurance, premiums remain level, and entire premiums are required to keep the policy in force.

- Premiums are generally higher for traditional whole life than for Trustmark’s permanent universal life options.

- Traditional whole life has higher guaranteed cash values than Trustmark’s permanent universal life options.

- Because the Trustmark permanent universal life premiums are generally lower, you can purchase a higher death benefit with the same premium dollars than traditional whole life.

Employee Assistance Program (EAP)

Life presents complex challenges. If the unexpected happens, you want to know that you and your family have simple solutions to help you cope with the stress and life changes that may result. That’s why Effingham County Schools provides Unum's employer-paid Employee Assistance Program (EAP) to you, your spouse, your children, and your parents. Their straightforward approach takes the complexity out of managing stress when life throws you a curve. Getting in touch is easy: simply call (800) 854-1446.

For the everyday issues like job pressures, relationships, retirement planning, personal grief, loss, or a disability, the Employee Assistance Program can be your resource for professional support.

The service includes unlimited telephonic support, and up to 3 face-to-face emotional or work-life counseling sessions per occurrence per year, so each member of your family can get counseling help for their own unique needs. Legal and financial counseling are also available by telephone during regular business hours.

Your Employee Assistance Program also includes a will preparation service. Preparing a will doesn't have to be complicated- or expensive. The Employee Assistance Program includes simple tools that can help you create a basic will in no time.

Counseling Services

Emotional or Work-Life Counseling

Helps address stress, relationship, or other personal issues you or your family members may face. It’s staffed by licensed professional counselors who listen to concerns and quickly make referrals to in-person counseling or other valuable resources. Situations may include:

-

Job pressures

-

Relationship/marital conflicts

-

Stress, anxiety and depression

-

Work/school disagreements

-

Substance abuse

-

Child and elder care referral services

Included with EAP: Health Advocate

- 3 telephone consultations with a licensed counselor per issue.

- Counselors are available 24/7

- Bi-lingual (English and Spanish speaking capability)

- Counselors can refer employees to longer term assistance, if needed.

- Network of attorneys – Service includes a free 30 minute consultation per legal issue with licensed attorney.

- Discount on Attorney Services – following Initial Attorney Consultation, 25% discount off standard legal fees as offered by Health Advocate’s network of attorneys.

- Medical Bill Saver - On behalf of the employee, HealthAdvocate will contact providers to negotiate the balance on any uncovered medical or dental bill over $400.

- Website - Includes access to 75+ free webinars with a variety of help topics. Many of these have a course completion certificate the employee is awarded with upon completion.

- There is also information on budgeting, estate planning, custody, wills & estates and more with access to the most commonly used forms and materials related to each topic.

Work / Life Balance Services

Provides support for help with balancing the demands of home, family, and the workplace. Specialists answer questions and put employees in touch with outside resources. Topics may include:

-

Childcare Services

-

Babysitter tips

-

Community resources

-

Pre-schools

-

-

Eldercare Services

-

Assisted living facilities / independent living options

-

Nursing homes or adult daycare services

-

Services for adults with disabilities

-

-

Financial Services

-

Debt management solutions

-

Budgeting assistance

-

Credit report assistance

-

-

Legal Services

-

Personal / family and elder law

-

Real estate

-

Identity Theft

-

Travel Assistance - AssistAmerica

Unum also provides a Travel Assistance benefit, which gives you access to resources while traveling. Whenever you travel 100 miles or more from home — to another country or just another city — be sure to pack your worldwide emergency travel assistance phone number. Travel assistance speaks your language, helping you locate hospitals, embassies, and other “unexpected” travel destinations. Just one phone call connects you and your family to medical and other important services 24 hours a day.

- Downloading the app, AssistAmerica, before you travel is a good idea since it can take your location from your phone and can send help to that location if you don’t know where you are.

- The service can help with finding a hospital, transportation, critical care, legal referral, and passport replacement.

- Emergency evacuation to a 1st world medical facility and transportation for family members to join the insured hospitalized for an extended period

- Legal referral (including assistance with bail bonds)

- Personal services (including emergency funds transfer & assistance in replacing lost/stolen travel documents)

Retirement & Savings

The retirement plans, Teachers Retirement System (TRS) and Public School Employees Retirement System (PSERS), that are available to employees are established by the Georgia Legislature. The governing boards determine the plan design and employee contribution amounts. Effingham County Board of Education provides payroll deductions for your contributions and other administrative support. We also offer the 403(b) and 457(b) Supplemental Retirement Plans to help you prepare for the retirement you deserve.

Teachers Retirement System (TRS)

The Teachers Retirement System (TRS) is a defined benefit plan, meaning participants are guaranteed a set monthly retirement income from the plan. Eligible positions include: Certified Teachers, Administrators, Clerical Staff, Paraprofessionals, Lead Custodians, and School Nutrition Managers.

How Does It Work? All TRS employees contribute 6% of gross salary to TRS through monthly payroll deduction. In addition, Effingham County Schools contributes 21.91% to each TRS employee’s retirement account monthly.

TRS members are vested with 10 years of creditable service and eligible to receive a monthly retirement benefit at the:

- Completion of 10 years of creditable service and attainment of age 60.

- Completion of 30 years of creditable service, regardless of age.

- Completion of 25 years of service and before age 60, but with a permanently reduced benefit.

The amount you will receive at retirement is based on 2%, multiplied by your years of creditable service, multiplied by the average of your highest consecutive 24 months of pay.

Example:

2% x 30 years = 60%

Average of highest 24 consecutive months of pay = $70,000

60% x $ 70,000 = $ 42,000 / year

You may contact TRS at (800) 352-0650 to request a benefit estimate be mailed to you. You may also generate a benefit estimate online by following the TRS Benefit Estimate Instructions found in the Resources section. The following documents are also avalable in the Resources section: TRS Member's Guide, TRS Retirement Checklist, and What to Do When Retiring.

Additional information is available here: https://www.facebook.com/trsgeorgia/.

Public School Employees Retirement (PSERS)

The Public School Employees Retirement System (PSERS) is the retirement system for public school employees who are not eligible to participate in TRS. This is also a defined benefit plan, so participants are guaranteed a set monthly retirement income. PSERS retirement income supplements income from Social Security for all employees in a permanent position, employed half time or more. Positions include: Maintenance and Custodial Staff, School Nutrition, Bus Drivers and Monitors, Transportation, and Warehouse staff.

How Does It Work? Participants in PSERS hired before 7/1/2012 contribute $4 monthly for a 9-month contribution period of September through May each year. Employees hired after 7/1/2012, without prior PSERS qualifying service, contribute $10 monthly for the 9-month period.

PSERS members are vested with 10 years of creditable service and eligible to receive a monthly retirement benefit at the:

- Completion of 10 years of creditable service and attainment of age 60, at a permanently reduced benefit.

- Completion of 10 years of creditable service and attainment of age 65 with full benefits.

The amount you receive in retirement is based on your years of creditable service multiplied by a set dollar amount. The current amount set by the Georgia General Assembly is $17.00.

For example, an employee with 30 years of creditable service would receive a monthly benefit based on the calculation of $17.00 X 30 years of service = $510.00 per month.

For employees enrolled in PSERS, Effingham County School District matches 50% of your Supplemental Retirement contributions through Corebridge Financial, up to a maximum of 6%. For more information, please refer to the 403(b) Retirement Savings Plan section or contact Corebridge at (800) 448-2542.

You may contact PSERS at (800) 805-4609 to request a benefit estimate be mailed to you. You may also generate a benefit estimate online by following the PSERS Benefit Estimate Instructions found in the Resources section. You can also download the PSERS Employee Handbook from the Resources section.

Third Party Administrator for Supplemental Retirement Plans

Arista is your Third Party Administrator for the Supplemental Retirement plans, and their service platform is designed to improve employee engagement in the 403b/457 Plan. In addition to the standard administrative services, Arista coordinates educational programs and new, diverse investment offerings. This is designed to help you understand your Retirement Savings options and why Retirement Saving is important. If you would like to speak to a Retirement Plan team member at Arista, please contact them using the information on the Resources page. A dedicated team member will be glad to help.

403(b) and 457(b) Retirement Savings Plans

Retirement savings plans are available if you wish to supplement your retirement benefits. You have the choice of the following carriers: Horace Mann, Corebridge Financial Services (formerly AIG/VALIC), or Vision Financial.

The Effingham County Board of Education provides a 403(b) plan via Corebridge Financial, supplementing the state’s PSERS retirement plan. ECSD will match 50% of your contributions, up to a maximum of 6%. To enroll, contact Corebridge at (800) 448-2542.

457(b) Retirement Savings Plan

In determining if a 457(b) Roth account is right for you, we encourage you to carefully assess the advantages and disadvantages. A 457(b) Roth may appeal to those who:

- Cannot contribute to a Roth IRA due to income limits

- Are young and in lower income tax brackets than they expect to be in retirement

- Are financially stable, but expect tax rate increases

- Want tax diversity and flexibility in retirement

403(b) Retirement Savings Plan

A Roth account can be a way to boost your savings or reduce your taxable income in the future. The account will allow you to set aside after-tax money, and after five years, make tax-free withdrawals of principal, interest, and earnings if certain conditions are met.

Planning to Retire?

For more information on your retirement options, please review the SHBP Retirement Presentation available here.

If you have additional questions, please email the Benefits Service Center at help@effinghamschoolsbenefits.com.

Flexible Spending (FSA)

Effingham County Schools provides two Flexible Spending Accounts (FSAs) through Medcom. FSAs allow you to set aside a portion of your paycheck, pre-tax, to use for eligible expenses. Since Federal Income and Social Security taxes are not deducted from your contributions, it lowers your taxable income. You can choose to enroll in the Healthcare FSA, which covers medical, dental, vision, pharmacy, and other related costs, and/or the Dependent Care FSA, which is primarily for dependent daycare expenses. If you're enrolled in a High Deductible Health Plan (HDHP), you may also opt for a Limited Purpose Healthcare FSA, which can only be used for dental and vision expenses.

Over-the-counter (OTC) drugs are available without requiring a prescription. Some examples of allowed OTC items are:

- Cough medicines

- Cold medicines

- Allergy medicines

- Pain relievers, such as acetaminophen

Healthcare FSA accounts are limited to $3,300 per year. If you're married, your spouse can contribute up to the maximum their employer allows as well.

For Dependent Care FSAs, you may contribute up to $5,000 if you are married and filing a joint return, or if you are a single parent. If you are married and filing separately, you may contribute up to $2,500 per year per parent.

Use the money in these accounts to pay for eligible out-of-pocket healthcare (medical, dental, vision expenses) and dependent care (day care) expenses for yourself, your spouse, your children or for any person you claim as a dependent on your federal income tax return.

Remember to carefully estimate your plan year expenses when making an election. Typically, you must use all of the funds in your account by the end of the plan year or the money is forfeited per the IRS regulations.

2025 Plan Year Maximums

- Healthcare FSA: $3,300

- Dependent Care FSA: $5,000

Important Termination and Retirement Information:

Please note: if you terminate employment or retire, eligible FSA claims must be incurred prior to your benefits-end date, regardless of your FSA balance.

Healthcare FSA

For 2025, you may roll over up to $660 of unused Healthcare FSA monies into the next year's FSA plan, but you still want to estimate your current year FSA plan contribution carefully. According to the IRS guidelines, all unused FSA funds in excess of $660 will be forfeited.

You are not eligible to participate in the Healthcare Flexible Spending Account (FSA) plan if you are currently enrolled in a Health Savings Account (HSA).

A list of eligible vs ineligible expenses is available on the Resources page.

Dependent Care FSA

If your spouse is not employed, your dependent care expenses are not eligible for reimbursement unless your spouse is a full-time student or is physically or mentally incapable of caring for himself / herself.

Eligible Dependent Care FSA expenses include before and after-school programs, licensed day care centers, nursery school or preschool, summer day camps, transportation to and from eligible care, an adult-day-care center, or elder care (in your own home or someone else’s). You can elect a Dependent Care FSA even if you have declined health coverage

Eligible childcare providers can be individuals, such as a family member or friend. However, it's important to note that this category excludes individuals under the age of 19 who are related to you, including your own child or stepchild. Additionally, the caregiver cannot be someone whom you list as a dependent on your federal tax return.

To claim reimbursements for dependent care through this FSA, you must ensure that the service provider has either a federal tax ID number or a valid social security number. This documentation is essential to facilitate the reimbursement process.

Funds must be used by the end of the plan year to avoid forfeiture. However, the Dependent Care FSA plan includes a 2 ½ month grace period to incur claims. Dependent care FSA claims must be incurred by March 15 of the year following the end of the plan year to be considered for reimbursement.

Eligible Expenses Must Be for the Care of:

- A dependent child who is under age 13 and whom you claim as an exemption on your tax return

- A dependent child, elderly parent, or relative who is physically or mentally incapable of caring for himself or herself

Limited Purpose FSA

A Limited Purpose FSA is a healthcare spending account that can only be used for eligible vision and dental expenses. Unlike a Healthcare FSA, this account can be held at the same time as a Health Savings Account (HSA). When coordinated with an HSA, the limited purpose FSA can further reduce your taxes while allowing you to allocate HSA funds to other purposes – including retirement.

By eliminating the need to use your HSA funds for these expenses, you have more to spend on regular medical expenses. More important, funding dental and vision expenses from a limited purpose FSA may also allow you to keep more savings in your HSA. Over time, those additional savings can really add up.

Debit Cards & Manual Claims

Debit Card Purchases

You will receive a debit card for your FSA plan. This debit card may be used to pay for eligible medical care expenses. Using a debit card is a convenient way to pay for your FSA expenses as many health providers accept the debit card. When you use your debit card, the funds are pulled from your account and paid to the health provider directly. This eliminates the need for you to pay out-of-pocket and file a claim to be reimbursed.

Please remember to keep all FSA claim receipts, even if you use your debit card. Some debit card claims will require you to provide a receipt to the plan administrator. In the event the FSA administrator needs additional information from you, you will receive a communication requesting receipt(s).

Manual Claims

Not all vendors accept the debit card. Should you need to pay for an eligible expense and be reimbursed from your FSA, you will need to submit a claim to the address indicated on the claim form with appropriate documentation.

Use It or Lose It

The IRS requires that any unused money in your account at the end of the plan year must be retained by your employer. You must use all of the funds in your account by the end of the plan year or the funds are forfeited. However, the IRS allows Healthcare FSA plan members to roll over up to $660 of unused funds for use in the following year. The $660 roll over option does not apply to the Dependent Care FSA.

Plan Year

The plan year runs from January 1 through December 31. Refer to the Summary Plan Description (SPD) for details.

Mobile and Online Member Tools

Once you are enrolled, you may access https://medcom.wealthcareportal.com and register as a member. You may access your balance and claims information, and view other important FSA plan information on this website.

Medcom also offers a free mobile app for FSA participants to access your accounts from anywhere at any time. You will enjoy convenient mobile options to check balances, view transaction details, request a reimbursement, and submit documentation on the go.

Identity Protection

You probably don't leave your house or car unlocked. But many of us do exactly that with our most valued assets - our personal and financial information. Without a watchful eye, your credit cards, bank accounts, personal details, and reputation can end up in the wrong hands. Don't become the cybercriminals' next victim. Protect yourself and your family with award-winning credit and identity monitoring. Allstate Identity Protection+ helps pay certain out-of-pocket expenses in the event you’re a victim of identity theft.

Allstate Identity Protection+ is designed to help you regain control of your name and finances after identity theft occurs. Trained counselors walk you through the process of remediating any damage. They help you write letters to creditors and debt collectors, place a freeze on your credit report to prevent an identity thief from opening new accounts in your name, and guide you through the restoration process.

Allstate Identity Protection+

Proactive Credit Monitoring

Annual Credit Reports & Score(s)

Credit Score Tracking

Credit Freeze Assistance

Stolen Fund Reimbursement

IP Address Monitoring

24/7 Remediation Support

100% Fully-Managed Resolution up to $1M

Wellness

Sharecare, the wellness program vendor, provides comprehensive well-being and incentive programs for SHBP members. As you complete wellness activities and earn Well-Being Incentive Points, these points are saved in the Sharecare Redemption Center until you choose to redeem them.

All employees and covered spouses are eligible to receive Well-Being Incentive points for completion of activities between January 1 and December 1. These points offset your medical and pharmacy expenses.

You and your spouse may earn 120 points for the RealAge Test and 120 points for the Biometric Screening. Once you have completed your Well-Being Assessment, you may participate in telephonic coaching or online tracking to earn additional points. For telephonic coaching, you can earn 40 incentive points for 1 call in a calendar month, up to 6 calls a year. You may also record items such as exercise and food servings on the Well-Being Connect portal and earn additional points. For online trackers, you can earn 40 points for the same trackers 5 times in a calendar month up to 6 times a year.

You and your spouse may earn a combined total of up to 960 in Wellbeing Incentive points. Incentive points will rollover in the new plan year, regardless of the option selected for the new year.

High Deductible Health plan members must meet a portion of your deductible before you are able to use your well-being incentive points. You must meet $1,650 for individual coverage and $3,300 for dependent coverage before wellness points are available. United Healthcare is matching the first 240 in well-being incentive points for employees and spouses.

Additional information on the program can be found by clicking here. A calendar of local biometric screening events is available here.

Steps to Wellness

Well-Being Incentive points are earned for completing activities during the plan year. Below are the steps to take to start earning!

- Real Age Test: A confidential, online questionnaire about your health.

- Biometric Screening: Assesses your health.

- Take Action with Coaching or Online Pathway: Phone coaching can earn you 40 points for one call in a calendar month up to 6 times / year. Online Pathways can earn you up to 120 points within a 90 day period. You can complete two events, for a maximum of 240 points.

Redemption Options

Employee and covered spouses can redeem well-being incentive points in one of two ways:

-

480 well-being incentive credits towards eligible medical and pharmacy expenses (can be redeemed in increments of 120 points to HIA, HRA or MIA) OR

-

A $150 Visa Reward Card that can be used anywhere Visa is accepted (expires one year after redemption)

Members need to go to the ShareCare website to choose the redemption option preferred. If members select to use the credits towards eligible expenses, the HMO reimbursement is done by check, and HRA credits are used at the point of service.

Disability & Sick Leave

Employees accrue sick leave at the rate of 1.25 days per month for the number of months you work (10 months, 11 months, or 12 months). You can bank up to 45 days of sick leave.

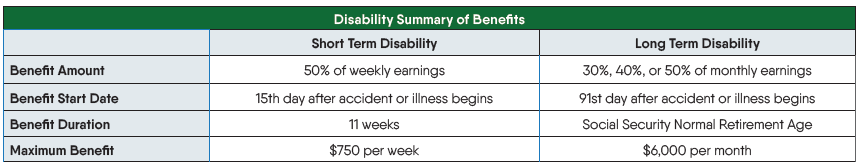

Effingham County Schools offers disability coverage through Unum, providing income replacement if you're unable to work due to illness or injury. It's essential to consider how long you could manage your expenses if you couldn't work. Short Term Disability replaces your income for up to 11 weeks, beginning on the 15th day of your disability. If your disability extends beyond 11 weeks, Long Term Disability begins on the 91st day and continues until you reach Normal Social Security Retirement age, provided you remain disabled. Disability insurance protects one of your most valuable assets—your ability to earn an income. Disabling illnesses and injuries are more common than many realize, and if you're out of work for weeks or months, this coverage helps you stay on top of regular expenses. Disability insurance benefits are paid in addition to any accrued sick leave.

Your maximum period of payment is based on your age at time of disability. Please see certificate for details.

Sick Leave Bank

You have the option to donate sick leave to help other employees when in need. In the event an employee or dependent suffers a catastrophic illness and has exhausted all his/her personal sick leave, the bank is available to provide additional days. Catastrophic is defined as a disabling injury, illness, or surgery requiring a disability period of longer than 20 continuous work days. Sick leave bank eligibility begins at the end of the 20-day period.

Benefits-eligible employees are eligible to participate in the sick leave bank, but you must have been employed for at least 1 year, and have accrued at least 6 sick leave days at the time of membership. Requests to join will only be accepted during the annual enrollment period and if approved, would be effective on the first working day in January. Please refer to the Effingham County Schools Employee Handbook for complete details.

Summary of Benefits

Pre-Existing Conditions - Short Term Disability

You have a pre-existing condition if you received medical treatment, consultation, care or services including diagnostic, or took prescribed drugs in the 3 months just prior to your effective date of coverage; and the disability begins in the first 6 months after your effective date of coverage. Once you have been insured on the Short Term Disability plan for 6 months, no limitation applies.

Pre-Existing Conditions - Long Term Disability

You have a pre-existing condition if you received medical treatment, consultation, care or services including diagnostic, or took prescribed drugs in the 3 months just prior to your effective date of coverage; and the disability begins in the first 12 months after your effective date of coverage. Once you have been insured on the plan for 12 months, no limitation applies.

Things to Consider

-

Short Term Disability Plan pays in addition to sick leave

-

Long Term Disability benefits are payable up to Social Security Normal Retirement Age

-

No offsets for other income on the Long Term Disability Plan

-

LTD benefits are payable to age 65 if you remain disabled

-

-

Disability plans are not portable

Group Legal

Studies show that seven out of ten employees experience one or more legal events in a year. We are pleased to offer a group legal plan that will help cover the costs of legal expenses associated with a variety of needs, including document preparation and review, family law, estate planning, traffic offenses, and more. As an Effingham County Schools employee, you have access to a variety of legal resources such as guidebooks and videos, a glossary, helpful website links, and a personal information organizer through ARAG, even if you are not enrolled in the legal plan. Click here for more information.

Effingham County Schools employees may enroll in the legal plan and access a variety of legal benefits. Telephone advice and office consultations with a network attorney are provided on an unlimited number of personal legal matters. Trials for covered matters are also covered.

Available Coverages

CONSUMER PROTECTION MATTERS

- Disputes over Consumer Goods and Services

- Small Claims Assistance

DEFENSE OF CIVIL LAWSUITS

- Administrative Hearings

- Civil Litigation Defense

- Incompetency Defense

- Pet Liabilities

- School Hearings

DOCUMENT PREPARATION & REVIEW

- Affidavits; Deeds; Demand Letters

- Mortgages

- Promissory Notes

- Review of Any Personal Legal Documents

ELDER LAW MATTERS

- Consultations and Document Review for issues related to your parents including Medicare, Medicaid, Prescription Plans, Nursing Home Agreements, Leases, Notes, Deeds, Wills and Powers of Attorney as these affect the Participant

ESTATE PLANNING DOCUMENTS

- Codicils

- Healthcare Proxies

- Living Wills

- Powers of Attorney (Healthcare, Financial, Childcare)

- Simple and Complex Wills

- Trusts (Revocable and Irrevocable)

FAMILY LAW

- Adoption and Legitimization

- Guardianship or Conservatorship

- Name Change

- Prenuptial Agreement

- Protection from Domestic Violence

- Divorce (contested and uncontested)

FINANCIAL MATTERS

- Debt Collection Defense

- Foreclosure Defense

- Identity Theft Defense

- Negotiations with Creditors

- Personal Bankruptcy

- Tax Audit Representation

- Tax Collection Defense

IMMIGRATION ASSISTANCE

- Advice and Consultation

- Preparation of Affidavits and Powers of Attorney

- Review of Immigration Documents

JUVENILE MATTERS

- Juvenile Court Defense, including Criminal Matters

- Parental Responsibility Matters

TRAFFIC OFFENSES

- Defense of Traffic Tickets (excludes DUI)

- Driving Privilege Restoration (Includes License Suspension due to DUI)

PERSONAL PROPERTY PROTECTION

- Assistance for disputes over goods and services

- Consultations and Document Review for Personal Property Issues

REAL ESTATE MATTERS

- Boundary or Title Disputes

- Eviction and Tenant Problems (Primary Residence - Tenant Only)

- Home Equity Loans (Primary, Secondary or Vacation Home)

- Property Tax Assessment

- Sale, Purchase or Refinancing (Primary, Secondary or Vacation Home)

- Security Deposit Assistance (For Tenant)

- Zoning Applications

When a participating attorney is used, services are covered at 100%. A participating attorney list is available on the Resources page or by visiting https://www.araglegal.com/plans and entering the code: 18598ecs.

Telephone and Office Consultations

- Consultations for an unlimited number of matters with an attorney

- During the consultation, the attorney will review the law, discuss your rights and responsibilities, explore your options, and recommend a course of action

- Trials for covered members are covered from beginning to end

All legal plan members have access to wills, durable power of attorneys, and other related documents at no cost via the two options below.

Access an in-network provider – no cost / covered in full

OR

Use your member login and access DIY online documents. With this option, you can complete a simple process online at no cost.

Participating Attorneys

When a participating attorney is used, services are covered at 100%.

A participating attorney list is available on the Resources page or by visiting https://www.araglegal.com/plans and entering the code: 18598ecs.

Legal Videos

All About Your Legal Insurance Webinar

Learn more about what legal insurance is and how ARAG legal insurance works.

Access Code: 18598ecs

DIY Docs® from ARAG®

With DIY Docs it's easier than ever to create more than 350 legally valid documents online that you can store, update and print - anytime.

Access Code: 18598ecs

5 Steps to Follow When Creating Your Estate Plans

Access Code: 18598ecs

4 Steps to Fighting a Traffic Ticket

Access Code: 18598ecs

Life Insurance and AD&D

Effingham County Schools provides employer-paid basic life insurance for you and your dependents through Unum. The plan includes Accidental Death and Dismemberment coverage, or AD&D. In the event of an accidental death, the plan provides a benefit equal to your life insurance amount, and it pays a percentage for the loss of limbs, speech, hearing, and other serious injuries.

Effingham County Schools also offers voluntary term life insurance and AD&D for employees, spouses, and children through Unum. Consider your current coverage and whether it would provide adequate protection for your family in the event of your death. These plans also include AD&D coverage.

Basic Life and AD&D

Effingham County Schools provides basic life coverage at no cost to you in the amount of $25,000 for employees, $10,000 for spouses, and $10,000 for child(ren).

Voluntary Life and AD&D

You may elect voluntary life insurance for yourself and your dependents through payroll deduction to supplement the basic life benefit.

Employee Life and AD&D: Up to a maximum of the lower of $500,000 or 10 times your annual earnings in the increments below.

- $10,000 increments to $100,000

- $25,000 increments from $100,000 to $200,000

- $50,000 increments from $200,000 to $500,000

- Guarantee Issue: Up to $350,000

Spouse Life and AD&D: Up to 100% of employee amount to a maximum of $500,000 in the increments below

- $5,000 increments to $50,000

- $25,000 increments from $50,000 to $200,000

- $50,000 increments from $200,000 to $500,000

- Guarantee Issue: Up to $75,000

Child Life and AD&D: $10,000 or $20,000 up to age 26

- Guarantee Issue: Up to $10,000

Evidence of Insurability (EOI) for Voluntary Life and AD&D

As a new hire, you are able to elect up to the Guarantee Issue of $350,000 for yourself, $75,000 for your spouse, and $10,000 for your child(ren) with no health questions. Should you wish to elect an amount that exceeds the Guarantee Issue, an Evidence of Insurability Form is required. You may obtain an EOI Form from the Resources page or by calling the Benefits Service Center. New elections at Annual Open Enrollment also require an Evidence of Insurability (EOI). To apply, simply complete the form and submit it to Unum for review. You will not be deducted for your pending amount unless / until you are approved.

If you elect coverage as a new hire, regardless of the amount, you can increase your insurance later, up to the maximum amount, with no health questions.

Sample Voluntary Life Premiums - $100,000

Please see below for sample premiums for $100,000 coverage. We encourage you to enroll in the plan because as long as you are enrolled, future elections up to the guarantee issue amounts during Annual Open Enrollment do not require health questions.

| Age | Monthly Deduction |

|---|---|

| 25 | $6.00 |

| 35 | $9.40 |

| 45 | $24.90 |

| 55 | $66.00 |

Important Notes

- There is no age cap to be eligible to enroll

- Spouse life cannot exceed 100% of employee amount

- Rates are age banded and spouse rates are based on employee's age

- Child(ren) can be covered until age 26

- Beneficiary information is required upon enrollment

- Accidental Death and Dismemberment (AD&D) coverage is included

- Benefit is doubled in the event of death due to accident

- Dismemberment benefit is paid according to a schedule outlined in the certificate

- If you are married to another Effingham County Schools employee:

- Duplicate coverage is allowed:

- You can both elect employee and spouse life coverage

- You can both elect to cover the child(ren)

- Duplicate coverage is allowed:

- For Dependent Basic life coverage, you must add any eligible dependents to the enrollment system. If there are no depdendents on file, the dependent basic life coverage will not be automatically enrolled.

Age Reductions

The basic and voluntary life benefits reduce due to age based on the schedule below. The change will take place on January 1 following the 70th birthday.

Age 70: Reduces to 65%

Age 75: Reduces to 50%

Portability and Conversion

You have the opportunity to continue your life insurance benefit should you separate employment with Effingham County Schools if certain conditions are met and if application and premium payment is made within 31 days of your coverage end date. You may either port your policy to an individual term life plan or convert your policy to a whole life plan upon separation. Additional information regarding these two options may be obtained by contacting Unum or by visiting the Resources page.

Vision

The Effingham County Schools Vision Plan with MetLife provides a benefit for an exam, either contact lenses or eyeglass lenses, and frames. If you see an in-network provider, you pay a copay for your standard eye exam/lenses/frames, and the plan pays a benefit of up to $130 for frames, and contact lenses. Additional copays apply for eyeglass lens options. Dependent children can be covered to age 26.

Access www.metlife.com/vision to locate provider network information. Select the VSP Choice Network.

With the MetLife Vision Plan, you may visit any vision provider. However in order to maximize your MetLife vision benefit, we encourage you to visit an in-network provider. Participating vision provider information can be found on the Resources page.

| Vision Summary of Benefits | In-Network |

|---|---|

|

Exam

|

|

| Standard | $20 copay |

| Contact Lens Fit and Follow-up | Covered in full with a maximum copay of $60 |

|

Lenses - Glasses

|

|

| Single | Covered in full after $20 copay |

| Bifocal | Covered in full after $20 copay |

| Trifocal | Covered in full after $20 copay |

| Lenticular | Covered in full after $20 copay |

| UV Treatment | $0 copay |

| Tint | $15 copay |

| Standard Polycarbonate - Kids under 19 | $0 copay |

|

Frames

|

Plan pays $130 after $20 copay Costco: Plan pays $70 after $20 copay |

|

Contact Lenses

|

|

| Conventional | Up to $130 allowance |

| Disposable | Up to $130 allowance |

| Medically necessary | Covered in full after $20 copay |

Frequencies

- Examination: Once per 12 months

- Lenses: One pair per 12 months

- Frames: One pair per 24 months

** Either eyeglass lenses or contact lenses are allowed per frequency **

Vision Plan Information

SHBP Vision Benefit

If you are enrolled in a SHBP Medical Plan, the plan covers 100% of one routine eye exam every 24 months. The plan does not extend to additional vision benefits such as eyeglasses or contact lenses.

State Health Benefit Plan (SHBP)

The State Health Benefit Plan (SHBP) is established for the benefit of school districts and other governmental employers by the Georgia legislature. SHBP operates through the Georgia Department of Community Health (DCH). SHBP and DCH determine the plan design, the monthly premiums, and the network providers. Effingham County Board of Education provides payroll deduction for your premium along with other administrative support. A Decision Guide is available for plan details, and the monthly premiums are available in the Premiums section.

You may choose between Anthem and UnitedHealthcare for your health plan coverage. Anthem offers four plan options: three HRA plans and one HMO plan. The HMO plan option provides in-network coverage only, and requires copays for many services. UnitedHealthcare offers an HMO similar to the Anthem plan, along with a High Deductible Health Plan (HDHP). The HDHP has the highest deductible and out-of-pocket costs, but the lowest premiums.

The Anthem plans include Gold, Silver, and Bronze HRA plan options, and an HMO plan option. On the HRA plan options, most services are subject to a deductible and there are no copays. After you meet your in-network deductible, you pay coinsurance up to the out-of-pocket maximum. For prescription drugs, you pay a percentage of the retail cost. The HRA plans include a plan-funded Health Reimbursement Account to reduce / offset your deductible and pharmacy expenses (unused balances carry forward into new plan years). Preventive care is covered at 100% in-network before the deductible.

The HMO plan option has the lowest deductible out of all plans, but provides in-network coverage only. Some services (office visits, ER visits, and prescription drugs) are covered at 100% after a copay. For most other services, you are responsible for a deductible and coinsurance until you meet your out-of-pocket maximum. Please be aware that copays do not count towards your deductible. Preventive care is always covered at 100% before the deductible.

The UnitedHealthcare plans include an HMO option and a High Deductible Health Plan (HDHP) option. This HMO plan has the same benefits as the Anthem HMO, but utilizes the UHC network.

The HDHP plan has the lowest premiums, highest deductible, and highest maximum out-of-pocket costs. All services, including pharmacy, are subject to the deductible and coinsurance, and there are no copays with this plan. Once you meet your deductible, you pay coinsurance until you satisfy the out-of-pocket maximum. As with the other State Health plan options, wellness incentive points can be earned by High Deductible Health Plan members. You are eligible to open an HSA if you enroll in the State Health Benefit Plan (SHBP) High Deductible Health Plan (HDHP) and do not have other coverage through 1) your spouse’s employer’s plan, 2) Medicare, or 3) Medicaid. The HSA is not set up through the district and must be established separately.

Effingham County Schools contributes $1,580 per employee per month (Classified) and $1,760 per employee per month (Certified) towards your medical coverage. Note: The employee rates are the same for each classification regardless of the employer portion.

Transfers from Other Georgia Systems

- If you transfer from another Georgia system, you must retain your current medical coverage for the remainder of the calendar year.

- No changes are allowed to your SHBP coverage until the next Open Enrollment period, unless you have a Qualifying Life Event (QLE).

Medicare

For active employees with spouses that are enrolled in Medicare and not disabled, SHBP is primary. The spouse is not required to elect Part B (medically necessary services such as outpatient care and preventive care) until the active employee retires. However, the spouse will automatically receive Part A (hospital insurance).

Please note: As a new hire, you have 31 days from your date of hire to enroll in your medical benefits.

|

Anthem HRA Plan - Gold In | Out |

Anthem HRA Plan - Silver In | Out |

Anthem HRA Plan - Bronze In | Out |

Anthem / UHC HMO Plan In (No Out-of-Network Coverage) |

UHC HDHP Plan In | Out |

|

|---|---|---|---|---|---|

|

Deductible

|

|||||

|

You

|

$1,500 | $3,000 | $2,000 | $4,000 | $2,500 | $5,000 | $1,300 | $3,500 | $7,000 |

|

You + Child(ren) / Spouse

|

$2,250 | $4,500 | $3,000 | $6,000 | $3,750 | $7,500 | $1,950 | $7,000|$14,000 |

|

You + Family

|

$3,000 | $6,000 | $4,000 | $8,000 | $5,000 | $10,000 | $2,600 | $7,000|$14,000 |

|

Medical Out-of-Pocket Max

|

|||||

|

You

|

$4,000 | $8,000 | $5,000 | $10,000 | $6,000 | $12,000 | $4,000 | $6,450 | $12,900 |

|

You + Child(ren) / Spouse

|

$6,000 | $12,000 | $7,500 | $15,000 | $9,000 | $18,000 | $6,500 | $12,900|$25,800 |

|

You + Family

|

$8,000 | $16,000 | $10,000 | $20,000 | $12,000 | $24,000 | $9,000 | $12,900|$25,800 |

|

Coinsurance (Plan Pays)

|

85% | 60% | 80% | 60% | 75% | 60% | 80% | 70% | 50% |

|

HRA Credits

|

|||||

|

You

|

$400 | $200 | $100 | N/A | N/A |

|

You + Child(ren) / Spouse

|

$600 | $300 | $150 | N/A | N/A |

|

You + Family

|

$800 | $400 | $200 | N/A | N/A |

|

Medical

|

|||||

|

ER

|

Coins after ded | Coins after ded | Coins after ded | $200 copay | Coins after ded |

|

Urgent Care

|

Coins after ded | Coins after ded | Coins after ded | $35 copay | Coins after ded |

|

PCP Visit

|

Coins after ded | Coins after ded | Coins after ded | $35 copay | Coins after ded |

|

Specialist Visit

|

Coins after ded | Coins after ded | Coins after ded | $45 copay | Coins after ded |

|

Preventive Care

|

100% | None | 100% | None | 100% | None | 100% | 100% | None |

Pharmacy Benefits

CVS Caremark is the pharmacy vendor for all medical options.

- For the HRA, you pay a percentage of the cost subject to a minimum and maximum per prescription.

- For the HMO plans, prescription drugs are covered at 100% after a copay at participating pharmacies.

- For the High Deductible Health Plan, prescription drugs are subject to deductible and then coinsurance, similar to other medical services.

The pharmacy costs are included in your out-of-pocket maximums, and a mail order benefit for a 90 day supply is also available. Additional details are located in the State Health Benefit Plan Decision Guide.

|

Retail Pharmacy |

Anthem Gold HRA |

Anthem Silver HRA |

Anthem Bronze HRA |

Anthem/UHC HMO |

UHC HDHP |

| Tier 1 |

15% Min $20 Max $50 |

15% Min $20 Max $50 |

15% Min $20 Max $50 |

$20 copay |

Coinsurance after deductible |

| Tier 2 |

25% Min $50 Max $80 |

25% Min $50 Max $80 |

25% Min $50 Max $80 |

$50 copay |

Coinsurance after deductible |

| Tier 3 |

25% Min $80 Max $125 |

25% Min $80 Max $125 |

25% Min $80 Max $125 |

$90 copay |

Coinsurance after deductible |

Disease Management Program

Managing chronic health conditions can be challenging, but the State Health Benefit Plan (SHBP) offers support to help ease the burden. Through SHBP's Disease Management Programs, you have access to valuable resources designed to help you better manage conditions like diabetes, asthma, coronary artery disease, and addiction. These programs provide personalized care and guidance, ensuring you stay on track with your treatment while also lowering your healthcare costs.

Certain drug costs are waived if SHBP is primary and you actively participate in one of the Disease Management Programs for diabetes, asthma, coronary artery disease, and/or medications for additction treatment.

To enroll in SHBP’s Disease Management Programs, you can access your SHBP enrollment portal online at mySHBPga.adp.com or contact SHBP Member Services at (800) 610-1863 for assistance.

Telemedicine

The medical plans include a telemedicine benefit through LiveHealthOnline, which allows you to speak to a participating doctor from home or work through your smartphone, tablet or computer 24 hours a day / 7 days a week.

You must use in-network providers for coverage to apply. HMO members pay a copay and HRA members pay coinsurance for telemedicine. High Deductible Health Plan members can access this benefit subject to the health plan deductible.

Consider utilizing your telemedicine benefit for non-complex medical conditions. Download the LiveHealth online mobile app (Anthem participants) or the Virtual Visits mobile app (UHC participants) for convenient access to telemedicine visits.

More information is available under Resources.

Enrollment - ADP Portal

How to complete your State Health Benefit Plan (SHBP) Enrollment through the ADP Portal.

- Access https://myshbpga.adp.com/shbp to review your health coverage elections. Your registration code is "SHBP-GA."

Once registered, you should:

-

Verify your address

-

Verify your coverage tier (you only, you & spouse, you & child(ren) or you & family)

-

Verify your dependents

-

Answer the Tobacco Surcharge question

-

Make sure you print your confirmation, write down the confirmation number, or save an electronic copy

Dependent Verification

- If you wish to add dependent(s) (spouse and / or children) to your health plan, ADP will contact you (by mail and email) to request appropriate verification documents. If you do not receive the request, contact SHBP directly to have the request sent to you. They can be reached at (800) 610-1863.

- The communication from ADP will include a personalized fax cover sheet with a bar code that must be used when submitting documentation.

- Appropriate documentation must be attached to the fax cover page and provided by the deadline set by ADP.

- Non-verified dependents cannot be reinstated until the next open enrollment period and would require appropriate documentation.

- Additional information can be found on the SHBP website.

Additional Resources

Go Online for More Resources

Access the two following plan websites to locate the participating providers and to find health and wellness tools, plan details, and to print ID cards.

Anthem

Select "Find Care' from the Main Menu and then follow instructions to find a doctor.

UnitedHealthcare

Select "Search for a Provider" under the Benefits drop down. Select "Choice HMO" or "HDHP with HSA" and follow the search instructions.

Other Medical Plan Options

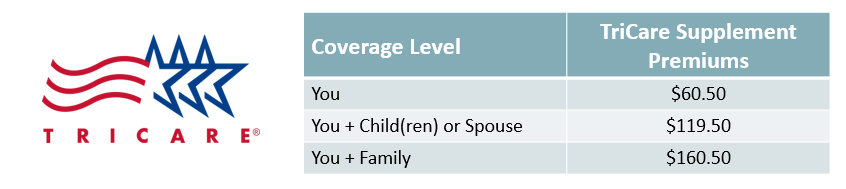

TRICARE Supplement Plan

The TRICARE Supplement Plan is available for retired military employees, and is a supplement to your current TRICARE benefits. The plan provides reimbursement of copays and other medical expenses associated with your current TRICARE plan. Additional information can be found here.

PeachCare for Kids

The state of Georgia offers an affordable health insurance program called PeachCare for Kids. This plan provides healthcare, dental, and vision benefits for children up to age 19. To learn if you are eligible, and to obtain benefits, cost, and application information, click here.

Shared Savings Program

Classified Employees May Be Eligible to Receive an Extra $3,000 Per Year.

Our Shared Savings Program allows you to receive a cash incentive to explore other healthcare options available to you. If you are a Classified Employee currently enrolled in medical coverage through State Health Benefit Plan - and you decline coverage during Annual Enrollment - you may be eligible for the Shared Savings program. Consider your options:

- If your spouse has coverage available, you may be eligible to enroll in their employer’s plan.

- If you are under age 26, you may be eligible to be covered under your parent’s benefit plan.

- Some employees may be covered both at the district AND under their spouse’s plan. If you are in this situation, you may not be receiving the full benefit for the money you are spending.

You are eligible for the Shared Savings Program, if you:

- Are a Classified Employee currently enrolled in the District’s medical plan

- You decline medical coverage during annual enrollment; and provide confirmation of declining

- You provide proof of other insurance for everyone in your “tax family” (who you claim as deductions for the current tax year)

- Return the enrollment form during Open Enrollment

If you meet the above criteria, you are eligible to receive a cash bonus of $3,000 per year, paid in equal monthly installments. Under IRS requirements, your cash bonus is considered taxable income.

Enrollment is only allowed during Open Enrollment or with a Qualifying Life Event. When you enroll in the Shared Savings program as a result of a QLE, the credit will be pro-rated. If you waive coverage from the District, you may re-enter the plan during the next annual enrollment period or if you have a Qualified Life Event, such as:

- You lose eligibility for other coverage due to the loss of spouse’s coverage

- Loss of your other group coverage due to divorce, termination, or a reduction in hours

- Marriage

- The birth or adoption of a child